TSYS Foresight ScoreSM with Featurespace®

Limit fraud losses. Generate more revenue. And give your customers the experience they want.

Fraud is a chess match and fraudsters are often one step ahead in the game. In fact, criminals are the best they’ve ever been at anticipating each new move the issuers and merchants might make and finding vulnerabilities in the protection methods.

Global card fraud losses for issuers and merchants were $21.84 billion in 2015.* They'll exceed $31 billion* by the year 2020 more than four times the number of people on the earth. It's estimated that for every $100 in purchases, nearly seven cents* was fraudulent in 2015.

Don't just try to keep up with fraudsters — proactively stop them in their tracks.

With Foresight Score, you can:

- Get data that can flex

- Take advantage of self-learning

- Capture data in real time

- Count on performance

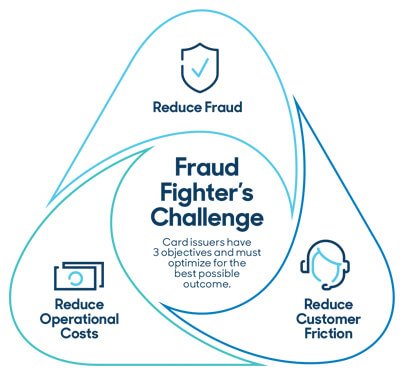

The problem is getting worse, not better. Fraud management teams are spending more time and effort dealing with blocked transactions, trying to separate genuine fraud from false positives.

So where do you look? You look to reduced operational costs. You look to enhanced precision. You look to real-time decisioning, improved efficiency and increased security.

That's Foresight Score, a leading scoring tool that incorporates machine learning capabilities to deliver significant advantages in the fight against fraud.

Foresight Score is your first line of defense.

Whether you're an issuer with a local, national or global presence, Foresight Score can help you stay ahead of constantly changing fraud trends.

It relies on Featurespace's powerful, adaptive behavioral analytics platform — ARIC® — which combines Bayesian statistical algorithms with the latest in machine learning. The result is an entirely new level in risk and fraud management, thanks to its ability to pick up subtle deviations from expected behavior.

What stands out about ARIC? First, it makes it possible to predict individual human interactions, in real time. Those predictions are built and updated quickly based on each customer's individual behavior rather than aggregated group data.

But where Foresight Score really excels is in card-not-present (CNP) and high-ticket transactions such as commercial purchases. The highly dynamic, self-learning fraud score has shown dramatic improvements on new and unknown types of fraud — such as the increasing number of CNP transactions driven by the rise of e-commerce and mobile transactions.

In short, it's a powerful tool to help you not just keep up with fraudsters, but proactively stop them in their tracks. That's Foresight Score.

Use data that's more dynamic

Many fraud scoring solutions rely on static data that has been sampled from very specific snapshots in time — a major disadvantage in the ever-evolving fight against fraud. These solutions are called consortium-based models.

Foresight Score is the ideal complement to existing consortium-based fraud detection tools. It makes use of machine learning and behavioral profiling for both monetary and non-monetary data to detect anomalies right down to the customer level. This means it spots fraud at the moment it occurs — without costly and time-consuming manual intervention.

Take advantage of self-learning

Fraud is evolving at a chaotic pace. And humans, understandably, have trouble keeping up.

While human involvement will always be required to review scores and block fraud attacks, the latest solutions have the ability to self-learn. This means they can stay up-to-date and adapt quickly based on each customer's individual behavior — without being overwhelmed by false positives.

With every change in datasets, Foresight Score learns more. It updates nightly, so the scoring tool can become faster and more responsive over ever-shorter timeframes.

We make sure customer profiles are built around what good transactions look like, rather than profiling what bad transactions look like. And the platform's predictive abilities don’t degrade over time; meaning there's no need for it to be updated periodically with new data.

Capture data in real time

Business and fraud schemes are evolving moment by moment, so any fraud-detection strategy that doesn’t keep pace simply won't suffice.

Business and fraud schemes are evolving moment by moment, so any fraud-detection strategy that doesn’t keep pace simply won't suffice.

Foresight Score is designed to capture data in real time. This allows models to constantly update over time based on changing datasets — which means it can be used to predict customer behavior and score individual transactions in real time.

Foresight Score is always evolving for the future. Which helps keep you far ahead of fraudsters.

There’s a lot more to tell you about Foresight Score. We’d love to talk to you about how it can help your business. Please call us at 1.844.663.8797 or email us sales@tsys.com.

DOWNLOAD THE PRODUCT BROCHURESign Up & Stay Connected to TSYS

A one-stop resource for white papers, featured content & industry insights